What are the best non life insurance companies in the Philippines?

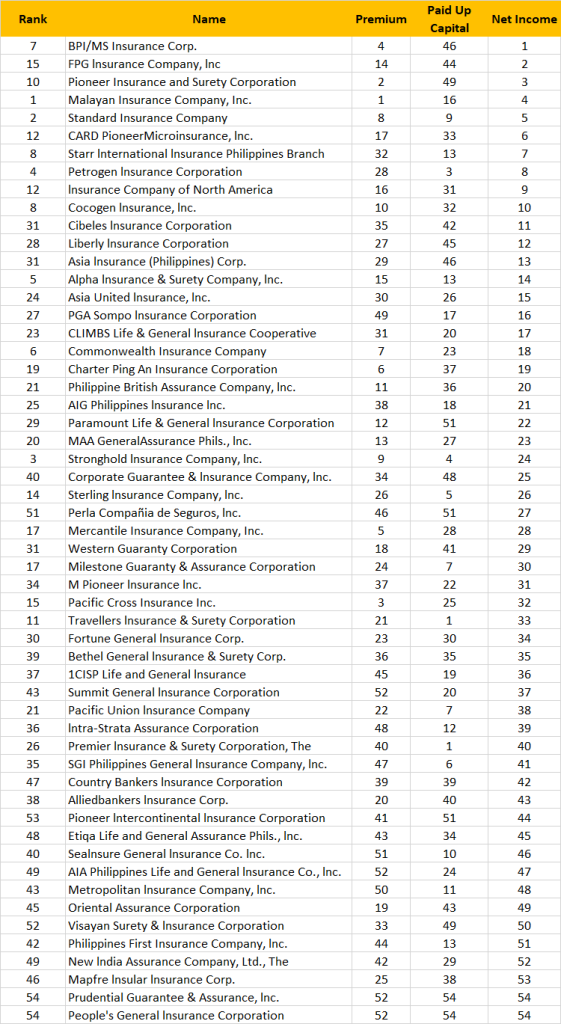

The annual financial statement that these companies submit to the Insurance Commission is a big help in determining which businesses are leading the pack. The agency released key data based on annual financial statements submitted in December 2022 by licensed composite and non-life insurance companies.

These data include the following metrics: Premium, Paid Up Capital, and Net Income.

A number of resources available online look at the ranking in each individual financial stat only. But is there a way to bring them together to produce an overall snapshot of performance?

Table of Contents

How the ranking is made

The list published by Insurance Commission already arranged the companies from highest to lowest in a given financial stat.

From there, all that is done is to bring everything together where each metric is given equal value. Here is the result.

Top 10 best non life insurance companies in the Philippines

| Rank | Company |

|---|---|

| 1 | Malayan Insurance Company, Inc. |

| 2 | Standard Insurance Company |

| 3 | Stronghold lnsurance Company, lnc. |

| 4 | Petrogen lnsurance Corporation |

| 5 | Alpha lnsurance & Surety Company, lnc. |

| 6 | Commonwealth Insurance Company |

| 7 | BPI/MS Insurance Corp. |

| 8 | Starr lnternational lnsurance Philippines Branch |

| 8 | Cocogen lnsurance, lnc. |

| 10 | Pioneer Insurance and Surety Corporation |

Malayan Insurance Company, Inc.

The company began as China Insurance and Surety Co. by Enrique T. Yuchengco in 1930. It was renamed Malayan Insurance Co., Inc. in February 1949.

- No. 1 in Premium

- No. 16 in Paid Up Capital

- No. 4 in Net Income

Standard Insurance Company

The company was established in 1958.

- No. 8 in Premium

- No. 9 in Paid Up Capital

- No. 5 in Net Income

Stronghold lnsurance Company, lnc.

The company was formerly known as Mabuhay Insurance & Guaranty Co., Inc. It was established on March 21, 1960. It was acquired by David C. Mercado in December 1980 and it was rebranded Stronghold Insurance Company, Inc.

- No. 9 in Premium

- No. 4 in Paid Up Capital

- No. 24 in Net Income

Petrogen lnsurance Corporation

The company was founded to cater to the insurance needs of Petron Corporation in 1996. In 2020, San Miguel Corporation infused P3 billion pesos of investment into the insurance company. It is the insurer of San Miguel Corporation with coverage on foods & beverages, petroleum, gas generation, and roads and tollways.

- No. 28 in Premium

- No. 3 in Paid Up Capital

- No. 8 in Net Income

Alpha lnsurance & Surety Company, lnc.

The company began on March 13, 1957. It is a domestic non life insurer that is 100% Filipino-owned. It used to cater to the insurance needs of its parent group Jacinto Group. It has since focused its business in providing motor car insurance and surety.

- No. 15 in Premium

- No. 13 in Paid Up Capital

- No. 14 in Net Income

Commonwealth Insurance Company

Commonwealth Insurance Company was established by Andres Soriano in 1935. Its ownership changed times several times, and the current business leaders took over on October 7, 1997.

- No. 7 in Premium

- No. 23 in Paid Up Capital

- No. 18 in Net Income

BPI/MS Insurance Corp.

BPI/MS Insurance Corporation is a joint venture of the Bank of the Philippine Islands and Japan-based general insurer Mitsui Sumitomo Insurance Company. It began FEB Mitsui, then owned by Far East Bank and Trust Company, in 1965. In 1998, it entered into partnership with Mitsui Marine and BPI Group in 2000.

- No. 4 in Premium

- No. 46 in Paid Up Capital

- No. 1 in Net Income

Starr lnternational lnsurance Philippines Branch

STARR International Insurance Philippines is a branch of Starr International Insruance (Asia) Limited in the Philippines. It was incorporated on April 19, 2013. its principal office address is in Makati City.

- No. 32 in Premium

- No. 13 in Paid Up Capital

- No. 7 in Net Income

Cocogen lnsurance, lnc.

The company began as Allied Guarantee Insurance company, Inc. It was established in January 1963 and became wholly owned non life insurance subsidiary of United Coconut Planters Life Assurance Corporation (Cocolife). It rebranded to Cocogen in 2019.

- No. 10 in Premium

- No. 32 in Paid Up Capital

- No. 10 in Net Income

Pioneer Insurance and Surety Corporation

Pioneer Insurance and Surety Corporation is the flagship company of the Pioneer Group. It was established in 1954.

- No. 2 in Premium

- No. 49 in Paid Up Capital

- No. 3 in Net Income

Based on Premium Income

| Premium Income Ranking | Company |

|---|---|

| 1 | Malayan Insurance Company, Inc. |

| 2 | Pioneer Insurance and Surety Corporation |

| 3 | Pacific Cross Insurance Inc. |

| 4 | BPI/MS Insurance Corp. |

| 5 | Mercantile Insurance Company, Inc. |

| 6 | Charter Ping An Insurance Corporation |

| 7 | Commonwealth Insurance Company |

| 8 | Standard Insurance Company |

| 9 | Stronghold lnsurance Company, lnc. |

| 10 | Cocogen lnsurance, lnc. |

Insurance companies generate premium income by receiving funds in exchange for providing coverage in the event of an untimely death or other specified incidents. This compensation is the remuneration they receive from individuals who are either acquiring a new policy or upkeeping an existing one.

The monetary inflow into insurance companies serves to indemnify them for assuming the associated risks when offering insurance. Essentially, it represents revenue earned for undertaking a financial obligation, which involves honoring claims in case of unforeseen events such as the insured’s unexpected demise, illness, accidents, or other contingencies outlined in the insurance contract.

Policyholders pay premium as a lump sum or on a periodic basis, such as monthly, quarterly, or annually. The calculation of the premium rate takes into account various factors, including the individual’s insurability, the type of coverage selected, the anticipated benefits, and other relevant considerations.

Premium income plays a pivotal role in the functioning of an insurance enterprise. It is utilized to cover the expenses associated with honoring claims, sustaining day-to-day operations, and achieving profitability. In essence, it is instrumental in enabling insurance companies to remain operational, stay competitive, and thrive in the market.

Based on Paid Up Capital

| Paid Up Capital Ranking | Company |

|---|---|

| 1 | Travellers lnsurance & Surety Corporation |

| 1 | Premier lnsurance & Surety Corporation, The |

| 3 | Petrogen lnsurance Corporation |

| 4 | Stronghold lnsurance Company, lnc. |

| 5 | Sterling lnsurance Company, lnc. |

| 6 | SGI Philippines General lnsurance Company, lnc. |

| 7 | Pacific Union lnsurance Company |

| 7 | Milestone Guaranty & Assurance Corporation |

| 9 | Standard Insurance Company |

| 10 | Sealnsure General lnsurance Co. lnc. |

Paid Up Capital refers to the funds that shareholders invest in a company. In return, they receive shares that represent their ownership interest in the company.

This capital holds significance within the company’s equity structure. Its primary purpose is to support the company’s operations, facilitate the exploration of growth prospects, enhance financial stability, establish credibility, and serve as a safeguard during periods of economic downturns.

Based on Net Income

| Net Income Ranking | Company |

|---|---|

| 1 | BPI/MS Insurance Corp. |

| 2 | FPG lnsurance Company, lnc |

| 3 | Pioneer Insurance and Surety Corporation |

| 4 | Malayan Insurance Company, Inc. |

| 5 | Standard Insurance Company |

| 6 | CARD Pioneer Microinsurance, lnc. |

| 7 | Starr lnternational lnsurance Philippines Branch |

| 8 | Petrogen lnsurance Corporation |

| 9 | lnsurance Company of North America |

| 10 | Cocogen lnsurance, lnc. |

Net Income is derived by calculating the disparity between total revenue and total expenses. This outcome reflects the overall profit or loss incurred by the company. A positive net income signifies a profit, whereas a negative net income indicates a loss.

Total revenue encompasses all the funds received by the company through its business activities, such as the sale of insurance policies. On the other hand, total expenses encompass costs associated with operations, expenditures, and taxes.

Net income serves as a key metric for gauging the overall financial well-being and performance of the company. It acts as a measure of the company’s profitability during a specific period.