What are the best life insurance companies in the Philippines?

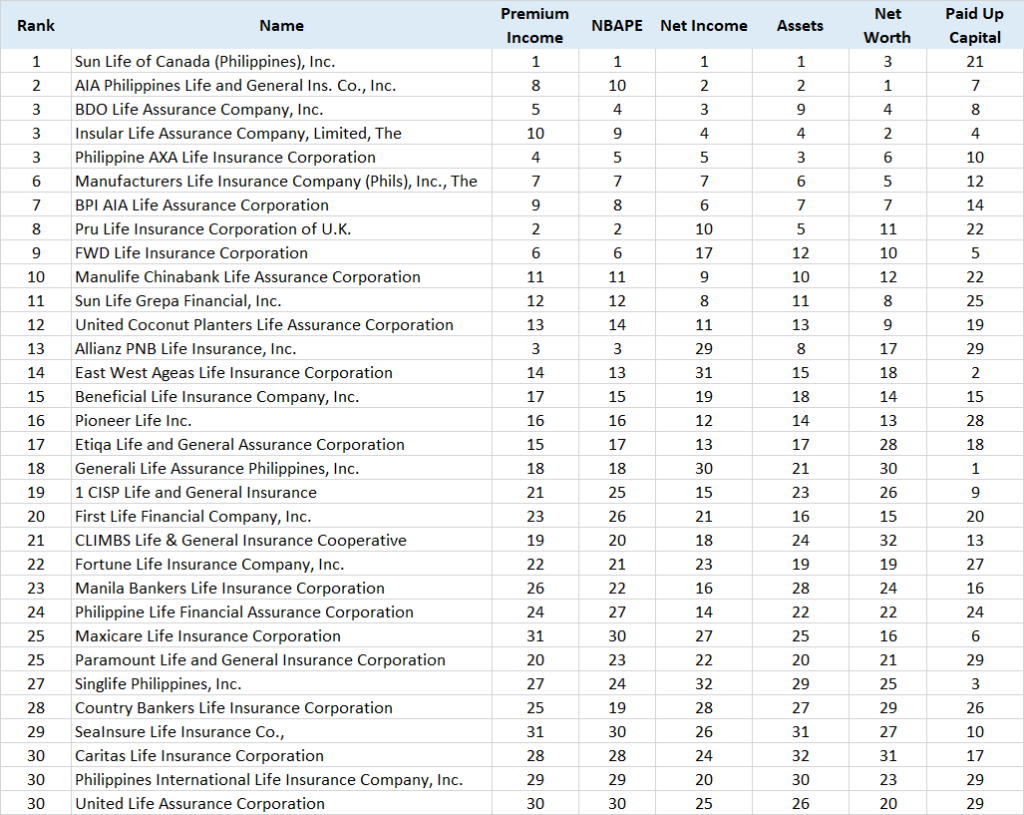

It is a fair question to ask, but many websites have different answers. What is common among them is that they rely on Insurance Commission’s key data based on annual financial statements submitted in December 2022 by licensed composite and life insurance companies. These data include the following metrics:

- Premium Income

- NBAPE (new business annual premium equivalent)

- Net Income

- Asset

- Net Worth

- Paid Up Capital

This article is an attempt in coming up with a ranking that takes all six financial data into account.

Table of Contents

How the ranking is made

A number of blogs and websites mention one or a few of these financial data to rank the companies. The resulting list creates an impression that one data is more important than others. Moreover, such a list gives higher standing to companies that had good numbers in one data but not in all others.

Is there a way to have a more complete and objective list of best life insurance companies?

This is an attempt in answering the question. The Insurance Commission already arranged the companies from highest to lowest in a given financial stat.

From there, all that is done is to bring everything together where each of the six metrics is given equal value. The final result is a consolidated picture of all companies offering life insurance products.

Top 10 best life insurance companies in the Philippines

| No. | Name |

|---|---|

| 1 | Sun Life of Canada (Philippines), Inc. |

| 2 | AIA Philippines Life and General Ins. Co., Inc. |

| 3 | BDO Life Assurance Company, Inc. |

| 3 | Insular Life Assurance Company, Limited, The |

| 3 | Philippine AXA Life Insurance Corporation |

| 6 | Manufacturers Life Insurance Company (Phils), Inc., The |

| 7 | BPI AIA Life Assurance Corporation |

| 8 | Pru Life Insurance Corporation of U.K. |

| 9 | FWD Life Insurance Corporation |

| 10 | Manulife Chinabank Life Assurance Corporation |

Sun Life of Canada (Philippines), Inc.

Sun Life Financial was established in the Philippines through British company H. J. Andrews and Co. in 1895. In 2011, it entered into partnership with Yuchengco Group to create Sun Life Grepa Financial Inc. It also has an asset management arm called named Sun Life Asset Management Company, Inc.

The company is in the top three in all but one metric.

- No. 1 in Premium Income

- No. 1 in NBAPE

- No. 1 in Net Income

- No. 1 in Assets

- No. 3 in Net Worth

- No. 21 in Paid Up Capital

AIA Philippines Life and General Ins. Co., Inc.

Also known as AIA Philippines, it began as Philam Life established by C.V Starr and Earl Carrol in 1947. In 2009, it was acquired by AIA. It entered into partnership with BPI to form the bancassurance entity called BPI-Philam Life Assurance Corporation in 2010.

The company is in the top ten across financial stats.

- No. 8 in Premium Income

- No. 10 in NBAPE

- No. 2 in Net Income

- No. 2 in Assets

- No. 1 in Net Worth

- No. 7 in Paid Up Capital

BDO Life Assurance Company, Inc.

BDO Life Assurance Company, Inc. is a subsidiary and the bancassurance arm of BDO Unibank, Inc. It began as a subsidiary of Generali Philippines Holdings Co. Inc. established in March 1999 as a joint venture between Generali Asia N.V., Jerneh Asia Berhad, and BDO Unibank, Inc.

In 2015, BDO and Generali terminated their partnership, where BDO owned Generali Philippines Holdings Co. Inc. (renamed BDO Assurance Holdings Corp.) and its life insurance arm Generali Pilipinas Life Assurance Co. (renamed BDO Life Assurance Co. Inc.).

The company is in the top ten across financial stats.

- No. 5 in Premium Income

- No. 4 in NBAPE

- No. 3 in Net Income

- No. 9 in Assets

- No. 4 in Net Worth

- No. 8 in Paid Up Capital

Insular Life Assurance Company, Limited, The

The company was established as the first Filipino life insurance company on November 25, 1910. It assumed businesses written by Filipinas Life Assurance Company in 1943 and Occidental Life Insurance Company of California in 1954. Its bancassurance arm is through a partnership with UnionBank.

The company is in the top ten across financial stats.

- No. 10 in Premium Income

- No. 9 in NBAPE

- No. 4 in Net Income

- No. 4 in Assets

- No. 2 in Net Worth

- No. 4 in Paid Up Capital

Philippine AXA Life Insurance Corporation

Philippine AXA Life Insurance Corporation began in 1999. it is a joint venture between France-based AXA Group, GT Capital Holdings, Inc. and Metropolitan Bank and Trust Company (Metrobank).

The company is in the top ten across financial stats.

- No. 4 in Premium Income

- No. 5 in NBAPE

- No. 5 in Net Income

- No. 3 in Assets

- No. 6 in Net Worth

- No. 10 in Paid Up Capital

Manufacturers Life Insurance Company (Phils), Inc., The

Manufacturers Life Insurance Company (Phils.), Inc., also called Manulife Philippines, began to sell insurance policy in the Philippines in 1901. It was granted a license after six years. In 1999, Manulife Philippines was established as a wholly-owned domestic subsidiary. In the same year, Manulife Financial Corporation debuted in the Philippine Stocks Exchange.

- No. 7 in Premium Income

- No. 7 in NBAPE

- No. 7 in Net Income

- No. 6 in Assets

- No. 5 in Net Worth

- No. 12 in Paid Up Capital

BPI AIA Life Assurance Corporation

BPI-AIA began as Filipinas Life Assurance Company in 1933, which was renamed to Ayala Life Assurance Incorporated (ALAI) in 1990. In 2009, Philippine American Life and General Insurance Co. acquired 51% of ALAI, and the result was joint venture named BPI-Philam. In 2021, it was renamed BPI AIA Life Assurance Corporation.

- No. 9 in Premium Income

- No. 8 in NBAPE

- No. 6 in Net Income

- No. 7 in Assets

- No. 7 in Net Worth

- No. 14 in Paid Up Capital

Pru Life Insurance Corporation of U.K.

Pru Life Insurance Corporation of UK is a subsidiary of British company Prudential PLC. It began its operations in 1996. In 2002, it acquired ING Life Philippines.

- No. 2 in Premium Income

- No. 2 in NBAPE

- No. 10 in Net Income

- No. 5 in Assets

- No. 11 in Net Worth

- No. 22 in Paid Up Capital

FWD Life Insurance Corporation

FWD is the insurance business of Pacific Century Group launched in 2013. They launched the single-pay insurance plan called All Set and regular-pay insurance plan called Set for Life in the Philippines in September 2014.

- No. 6 in Premium Income

- No. 6 in NBAPE

- No. 17 in Net Income

- No. 12 in Assets

- No. 10 in Net Worth

- No. 5 in Paid Up Capital

Manulife Chinabank Life Assurance Corporation

Manulife Chinabank Life Assurance Corporation was established in 2007. It is a bancassurance venture and partnership between Canada-based Manulife and China Bank.

- No. 11 in Premium Income

- No.11 in NBAPE

- No. 9 in Net Income

- No. 10 in Assets

- No. 12 in Net Worth

- No. 22 in Paid Up Capital

Based on premium income

| Premium Income Ranking | Company |

|---|---|

| 1 | Sun Life of Canada (Philippines), Inc. |

| 2 | Pru Life Insurance Corporation of U.K. |

| 3 | Allianz PNB Life Insurance, Inc. |

| 4 | Philippine AXA Life Insurance Corporation |

| 5 | BDO Life Assurance Company, Inc. |

| 6 | FWD Life Insurance Corporation |

| 7 | Manufacturers Life Insurance Company (Phils), Inc., The |

| 8 | AIA Philippines Life and General Ins. Co., Inc. |

| 9 | BPI AIA Life Assurance Corporation |

| 10 | Insular Life Assurance Company, Limited, The |

Premium income comes from the money they get in exchange for insuring people in the event of untimely death and other coverage. It is what they are paid for by those who are either buying a new policy or maintaining an existing one.

The amount of money that insurance companies receive compensates them for taking on the risks whenever they provide insurance. It is an income for delivering a financial obligation, which is to pay for claims in the event an insured dies unexpectedly, gets sick, meets an accident, or any other scenarios that are covered by the insurance contract.

The fees collected by insurers from their policyholders can be paid one time or on a regular basis such as monthly, quarterly, or annually. The premium rate is computed based on many factors including insurability, type of coverage, amount of expected benefits, etc.

Premium income is a crucial in operating an insurance business. It is used to cover the costs of claims, running their business, and making a profit. So it helps them to keep going, stay in business, and remain competitive in the market.

Based on NBAPE

| NBAPE Ranking | Company |

|---|---|

| 1 | Sun Life of Canada (Philippines), Inc. |

| 2 | Pru Life Insurance Corporation of U.K. |

| 3 | Allianz PNB Life Insurance, Inc. |

| 4 | BDO Life Assurance Company, Inc. |

| 5 | Philippine AXA Life Insurance Corporation |

| 6 | FWD Life Insurance Corporation |

| 7 | Manufacturers Life Insurance Company (Phils), Inc., The |

| 8 | BPI AIA Life Assurance Corporation |

| 9 | Insular Life Assurance Company, Limited, The |

| 10 | AIA Philippines Life and General Ins. Co., Inc. |

NBAPE is short for new business annual premium equivalent. According to the Insurance Commission, the data is derived from first year premium (that is, annualized and 10% of single premium.

The result is a figure that points to how well an insurance company is able to generate new business.

NBAPE is a way to measure the value of new policies sold. Its goal is to give an insight into the new business acquired by insurers. In a way, it helps in understanding and comparing how different insurance companies are doing particularly when attracting people to purchase their insurance products.

Based on Net Income

| Net Income Ranking | Company |

|---|---|

| 1 | Sun Life of Canada (Philippines), Inc. |

| 2 | AIA Philippines Life and General Ins. Co., Inc. |

| 3 | BDO Life Assurance Company, Inc. |

| 4 | Insular Life Assurance Company, Limited, The |

| 5 | Philippine AXA Life Insurance Corporation |

| 6 | BPI AIA Life Assurance Corporation |

| 7 | Manufacturers Life Insurance Company (Phils), Inc., The |

| 8 | Sun Life Grepa Financial, Inc. |

| 9 | Manulife Chinabank Life Assurance Corporation |

| 10 | Pru Life Insurance Corporation of U.K. |

Net income comes from getting the difference between total revenue and total expenses. The result points to the overall gain or loss of the company. If net income is positive, then it represents gain and if it is the opposite, then it represents the loss.

Total revenue is all money that the company has from the business such as selling insurance policies, while total expenses are from costs from operations, expenditures, and taxes.

Net income is an indicator of the overall financial health and performance of the company. It is a measure of how profitable the company in a given period of time.

Based on Asset

| Asset Ranking | Company |

|---|---|

| 1 | Sun Life of Canada (Philippines), Inc. |

| 2 | AIA Philippines Life and General Ins. Co., Inc. |

| 3 | Philippine AXA Life Insurance Corporation |

| 4 | Insular Life Assurance Company, Limited, The |

| 5 | Pru Life Insurance Corporation of U.K. |

| 6 | Manufacturers Life Insurance Company (Phils), Inc., The |

| 7 | BPI AIA Life Assurance Corporation |

| 8 | Allianz PNB Life Insurance, Inc. |

| 9 | BDO Life Assurance Company, Inc. |

| 10 | Manulife Chinabank Life Assurance Corporation |

An asset is anything that the company owns or is owed that is of value and expected to provide financial benefit. These can include investments, cash, reinsurance receivables, premium income, fixed and intangible assets.

The amount of assets that an insurance company holds is crucial in determining whether it can keep the business afloat. It indicates its ability to pay out claims, run the operations, and manage risks.

Based on Net Worth

| Net Worth Ranking | Company |

|---|---|

| 1 | AIA Philippines Life and General Ins. Co., Inc. |

| 2 | Insular Life Assurance Company, Limited, The |

| 3 | Sun Life of Canada (Philippines), Inc. |

| 4 | BDO Life Assurance Company, Inc. |

| 5 | Manufacturers Life Insurance Company (Phils), Inc., The |

| 6 | Philippine AXA Life Insurance Corporation |

| 7 | BPI AIA Life Assurance Corporation |

| 8 | Sun Life Grepa Financial, Inc. |

| 9 | United Coconut Planters Life Assurance Corporation |

| 10 | FWD Life Insurance Corporation |

Net worth is a measure of the total value of the company. It is also called shareholders’ equity. It is obtained by subtracting total liabilities from total assets.

In insurance companies, these can include the paid up capital, retained earnings, and other income such as the value of its invested assets.

In simple terms, net worth is whatever is left if the company is going to sell everything it owns and pay all debts. Having a positive net worth is a good thing because it means the company can handle its obligations such as paying out anyone who is filing a claim.

Based on Paid Up Capital

| Paid Up Capital Ranking | Company |

|---|---|

| 1 | Generali Life Assurance Philippines, Inc. |

| 2 | East West Ageas Life Insurance Corporation |

| 3 | Singlife Philippines, Inc. |

| 4 | Insular Life Assurance Company, Limited, The* |

| 5 | FWD Life Insurance Corporation |

| 6 | Maxicare Life Insurance Corporation |

| 7 | AIA Philippines Life and General Ins. Co., Inc. |

| 8 | BDO Life Assurance Company, Inc. |

| 9 | 1 CISP Life and General Insurance |

| 10 | Philippine AXA Life Insurance Corporation |

Paid-up capital is the money that shareholders have contributed to a company. In exchange, they are given shares which represent their ownership stakes of the company.

It plays an important role in the company’s equity. It is used to help the company run, pursue opportunities to grow, provide financial strength, build credibility, and act as cushion for any downturns.